Indian Bank Account Number Format

The first 4 digits of 15 digit.

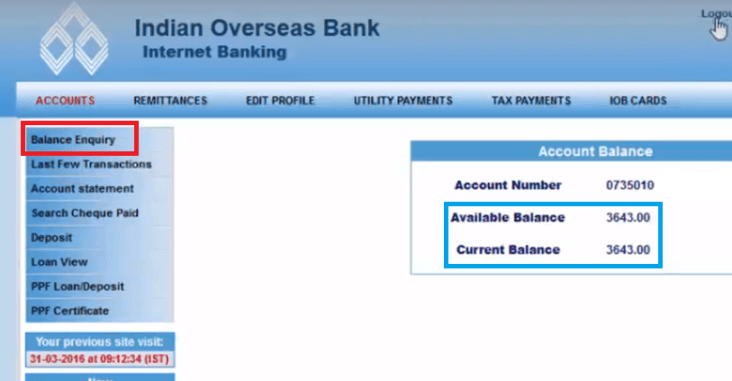

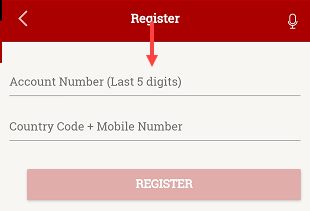

Indian bank account number format. Indian bank account numbers length may vary from 9 to 18 digits depending upon the core banking product used by the particular branch. The coding of bank of india account number is as under. Indian bank account number validation regex. The swift network does not require a specific format for the transaction so the identification of accounts and transaction types is left to agreements of the transaction partners.

Every account number is coded in a specific manner. Rbi in jan 2013 has released a report of the technical committee to examine uniform routing code and account number structure and unification of account number and iban. The international bank account number iban is an internationally agreed system of identifying bank accounts across national borders to facilitate the communication and processing of cross border transactions with a reduced risk of transcription errorsit was originally adopted by the european committee for banking standards ecbs and later as an international standard under iso 136161997. Format of bank of india account number.

Bancs and finacle are the two major core banking product used widely in india. Another identifier we store in our websites database is the. Different banks in india are using different banking core banking solution of different software companies. The overlapping issue between iso 9362 and iso 13616 is discussed in the article international bank account number also called iban.

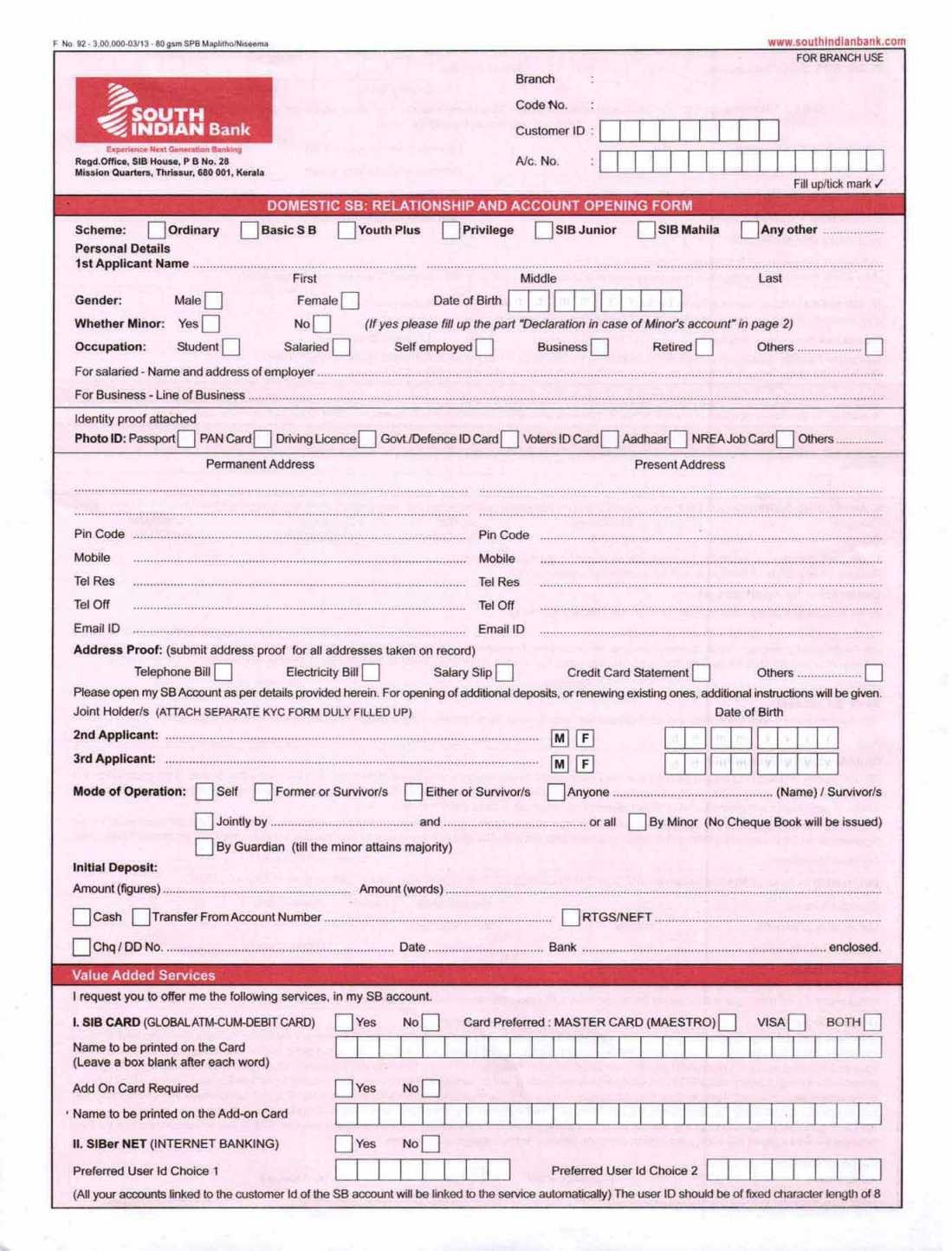

All these accounts have a different account numbers so if a customer wants to deposit money into loan account then it can be done by providing the loan account number. A corporate bank account number of digits is dependent upon the assignment from each individual bank. The account number format is different from bank to bank. This free reference website provides a quick and easy way to locate any indian banks ifsc code.

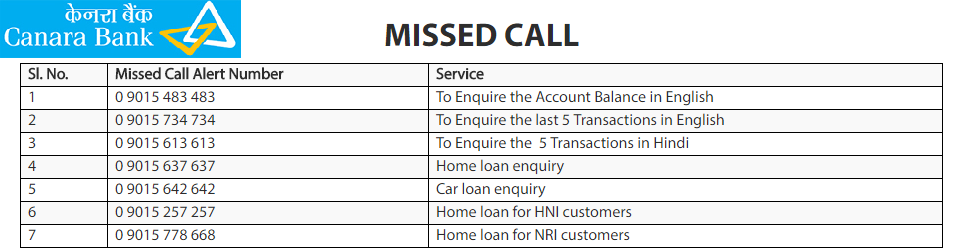

D918 a better way to validate would be to select the right bank and then have checks in place as per the bank which have been outlined and analyzed by the rbi here. Currently the most used electronic funds transfer services in india are the real time gross settlement rtgs and the national electronic funds transfer neft systems. Ifs codes are used when processing bank account payments in india. Hence the total number of digit are varies as per different type of banks.