Cit Bank Cd Rates

100 may not seem like much but you can make it grow into more.

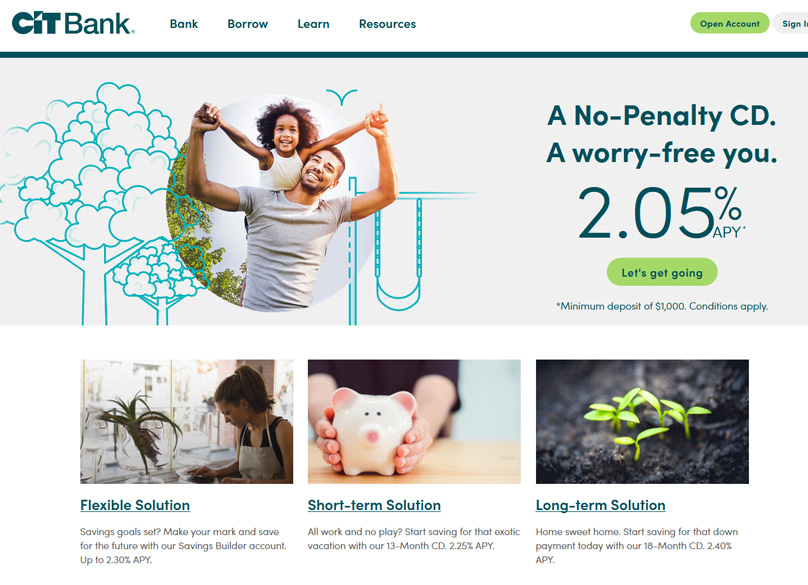

Cit bank cd rates. The best way to invest 100. The minimum to open is 5000 which is somewhat steep. Turn your savings into so much more. Cit bank cds range from short term 6 month and 1 year cds to a longer term 5 year cd.

The exception to this are the 13 month cd and the 18 month cds. 8 upon maturity cds are renewed for the same term automatically. Here are 10 clever ways to turn 100 into a better future. Get the details on cit bank savings money market and cd accounts with interest rates for maximum growth.

Its easy to open an account. Certificates of deposit cds are a safe way to deposit money and guarantee a return. Member fdic great cd rates. Currently cit bank offers up to 170 apy rates with their cd account.

6 cds may be subject to an early withdrawal penalty which will reduce earnings. Is cit bank online only. You just need a minimum deposit of 1000. You just need a minimum deposit of 1000.

With the cit bank no penalty cd you get a great rate the security of an 11 month cd and no penalty access to your funds if you need them. Its easy to open an account. Cit bank cd rates. Citizens access the online division of citizens bank has an 11 month no penalty cd with a rate similar to its online savings account.

Good online savings accounts have a high interest rate flexibility and are fully secured. Is a member of the federal deposit insurance corporation fdic which means your deposit accounts are insured up to 250000 per depositor for each account ownership category. This predictability can make it easier to estimate your earnings and plan for the future. View our cd selection now.

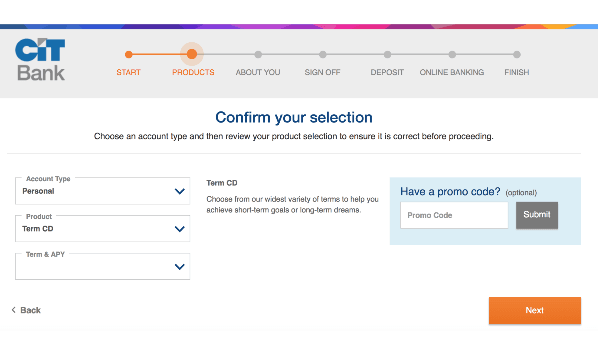

How to open cit bank application. Here are the best. Top 10 best online savings account.