Chime Bank Account

And may be used everywhere visa debit cards are accepted.

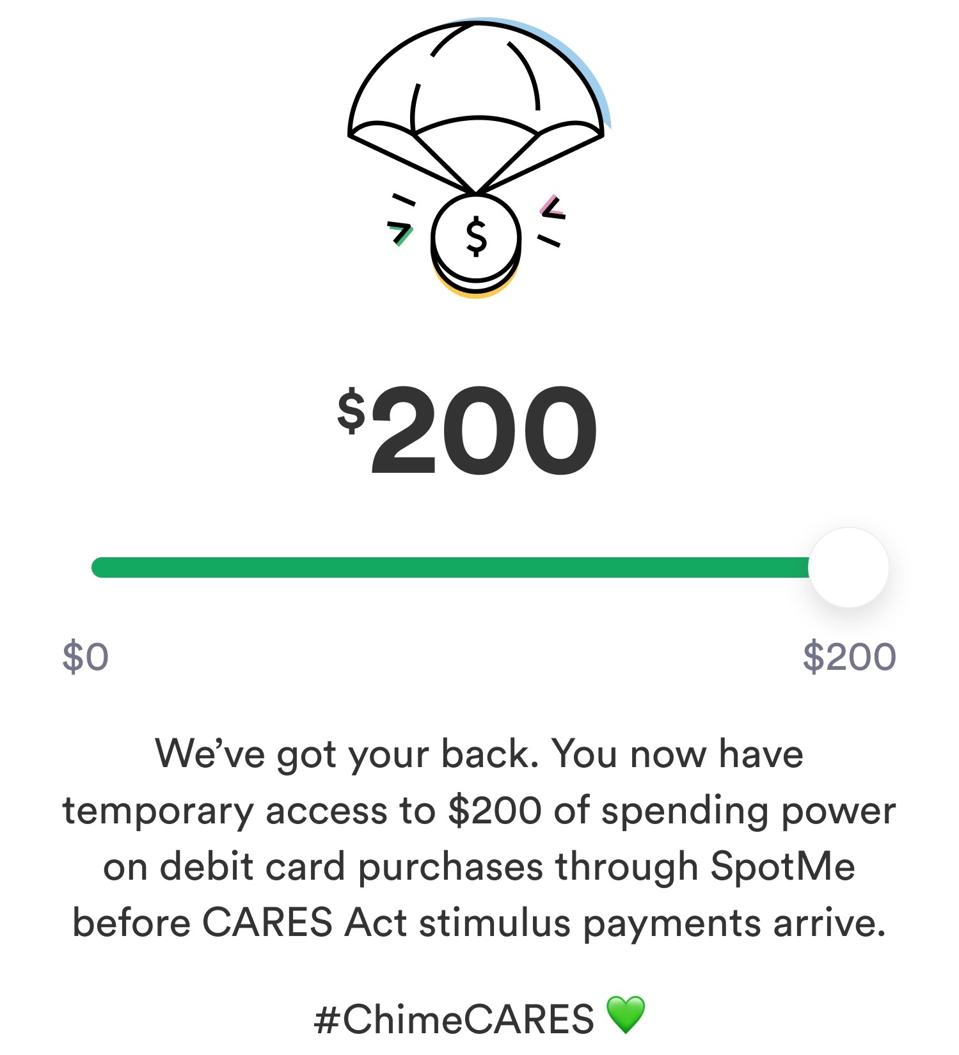

Chime bank account. Your limit will be displayed to you within the chime mobile app. Your limit may be increased or lowered at any time by chime. How do you use connected accounts. The chime visa debit card is issued by the bancorp bank or stride bank pursuant to a license from visa usa.

A savings account that helps you save money without thinking about it chime accounts are insured up to the standard maximum deposit insurance amount of 250000 through our partner banks stride bank na. Chime offers a spending account that provides a second chance to rebuild your financial health because it doesnt rely on consumer credit reporting agencies like chexsystems. The chime visa credit builder card is issued by stride bank pursuant to a license from visa usa. Chime accounts can be linked with external bank accounts through the services provided by plaid.

While a bank may leave you struggling to figure out how to maneuver around the monthly account chime keeps it simple with almost no fees at all. Banking services provided by the bancorp bank or stride bank na members fdic. There is no difference in features benefits or member experience between the two banks. Im going to give it a shot for a little while but ill likely wind up moving away from chime sooner rather than later.

The only fee listed is an out of network atm fee that chime charges you when you use an atm outside the chimes atm network. Ive looked around though including on chimes own site and i havent seen anything to suggest that i will. Theres no opening deposit requirement no minimum balance requirement and no monthly fee. Chime in its sole discretion may allow you to withdraw your account up to 100 or more based on your chime account history direct deposit history and amount spending activity and other risk based factors.

You must use the routing number displayed in your app. Banking services provided by the bancorp bank or stride bank na members fdic. You will receive notice of any changes to your limit. Your chime account is specifically tied to one of these banks.

Doing so will ensure your funds are correctly directed to. Chime has even nixed the. An fdic insured deposit account that can be managed entirely from your smartphone. The chime visa debit card is issued by the bancorp bank or stride bank pursuant to a license from visa usa.

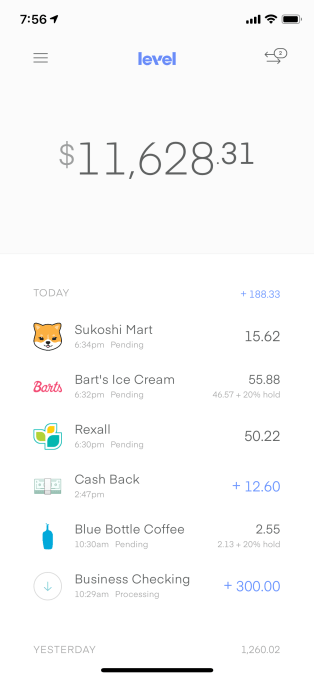

And may be used everywhere visa debit cards are accepted. Please see back of your card for its issuing bank. Or the bancorp bank members fdic. For users on ios running app version 33 or later any external bank accounts that have been linked to your chime spending account now appear in a widget on the home page of the chime mobile app.

A chime visa debit card. See how chime compares to other second chance bank accounts. Chime partners with two banks the bancorp bank and stride bank to support your account and create an improved member experience.