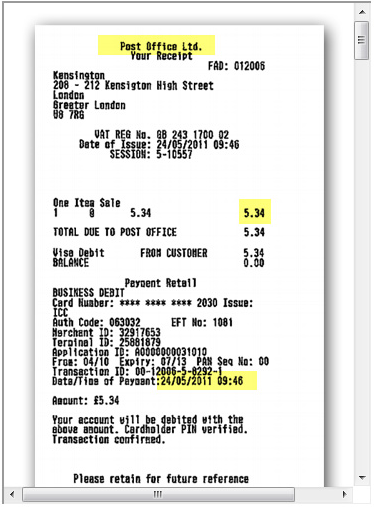

Bank Transaction Receipt

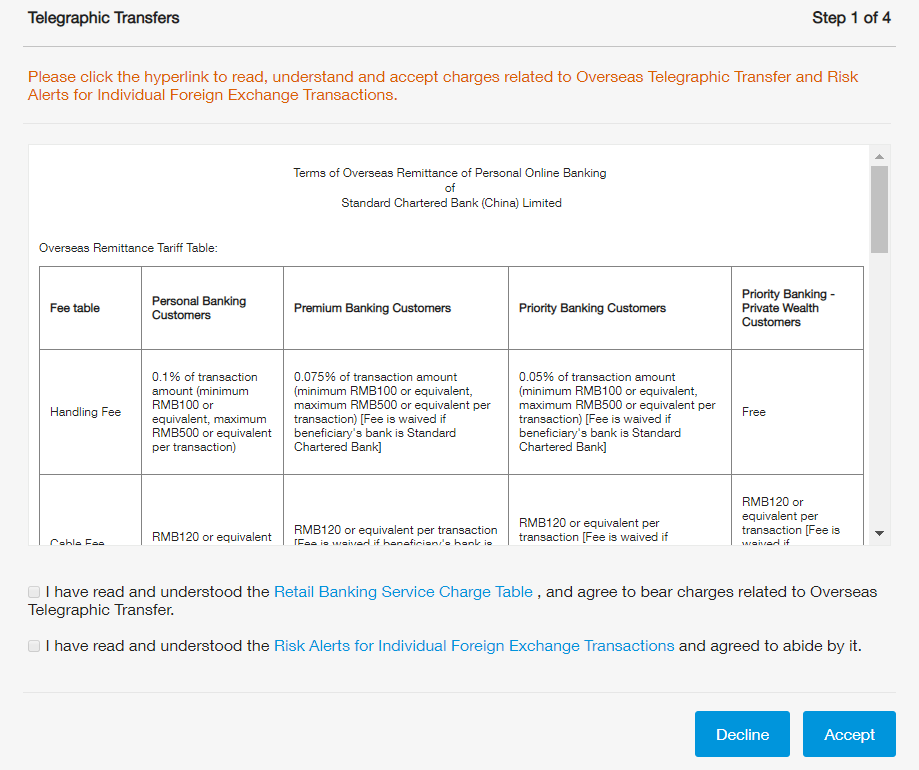

I still wouldnt use an internet cafe to access anything private but if someone had to in an emergency they would get alerts if their credentials were stolen.

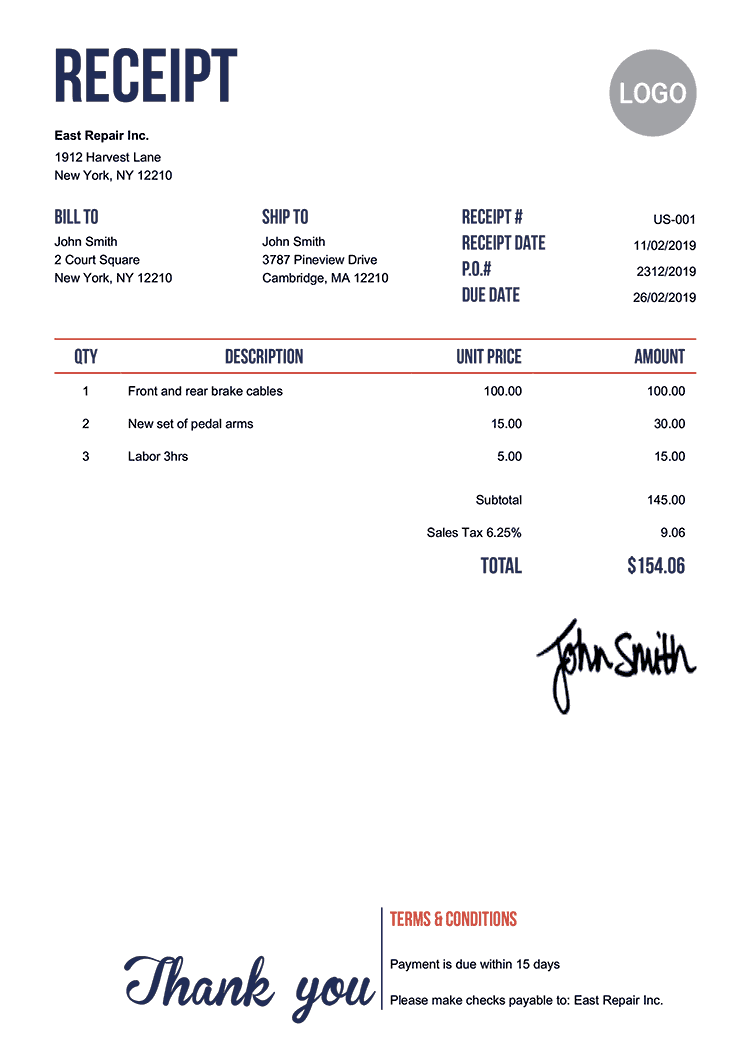

Bank transaction receipt. Without receipts enters a transaction to the checkbook only has no gl or sub ledger impact. Businesses typically keep bank receipts until the end of the year so that the receipts can be used for tax preparation purposes. If i didnt make the transaction id need to ring the bank in the usual way to get them to stop it and then change my passcode. Existing receipt that wont be assigned to a deposit because the amount has already been deposited the.

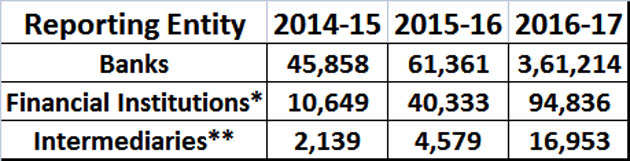

The transaction can be an outgoing or incoming payment. Mentorjay thank you. Bank receipt is a document issued by chinese banks to record the data for a single transaction posted on a bank account. Clear unused receipts used to clear receipt transaction to remove receipts from the system.

The 1 pre accounting tool for accountants and bookkeepers. Receipt bank helps accountants bookkeepers and small businesses go paperless and do more of what they love. Very useful if youre travelling abroad. Individuals who claim tax deductions for certain kinds of expenses must also keep copies of bank receipts to.

This all will be on a piece of paper with the name and logo of bank from whose atm you are transacting and the name of your own bank. Chinese companies often use the data from bank receipts to do the follow on postings for vendor invoices or customer payments in. With receipts generated from ar cash receipt ap return or bank transaction entry. Use the information in this microsoft dynamics gp bank reconciliation transactions article you can ensure that your checkbooks accurately reflect the transaction detail that appears on your monthly bank statements.

No more data entry. You can enter and save deposits for posting later but you can save only one deposit with receipts transaction or one deposit to clear receipts transaction for each checkbook at any given time. The receipt will have users name the date on which transaction occurred his account number and other account details along with the amount withdrawn by him in currency and the amount that is remaining in his account. Bank reconciliation records are updated using the date you entered in the bank transaction entry bank transfer entry reconcile bank adjustments or bank deposit entry windows.