Bank Reconciliation Statement Formula

First of we should match all the debit entries and credit entries in bank ledger and bank statement of abc international.

Bank reconciliation statement formula. It verifies that both the sides of a statement are balanced. The reconciliation statement helps identify differences between the bank. On the bank statement compare the companys list of issued checks and deposits to the checks shown on the statement to identify uncleared checks and deposits in transit. Locate them on the bank statement and tick off these and opening balances as now agreeing.

A bank reconciliation is the process of matching the balances in an entitys accounting records for a cash account to the corresponding information on a bank statementthe goal of this process is to ascertain the differences between the two and to book changes to the accounting records as appropriate. Deduct any outstanding checks. This page shows the bank reconciliation formula to calculate the account reconciliation for a statement based on the balance from check register ending balance shown on your statement total deposits and the total. In column b create a unique record for every pair ie.

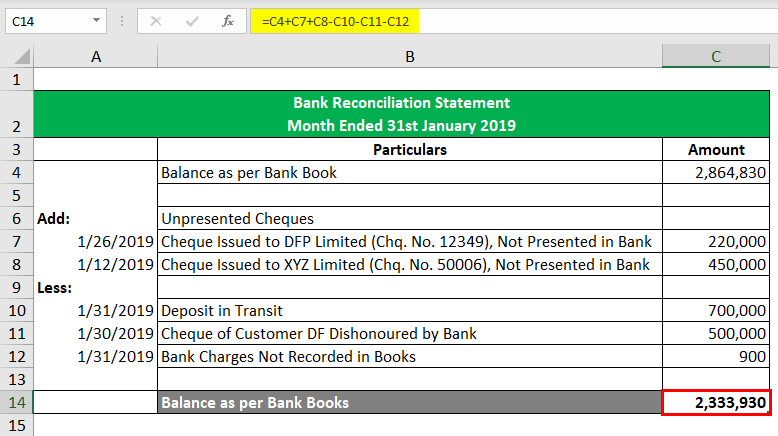

The process for preparing the bank reconciliation statement brs follows the below steps or method. Bank reconciliation statements ensure payments have been processed and cash collections have been deposited into the bank. Prepared the bank reconciliation statement for 31 st january 2019. Account reconciliation is an accounting process to maintain the consistency and accuracy in financial accounting.

Using the cash balance shown on the bank statement add back any deposits in transit. When the company receives its bank statement the company should verify that the amounts on the bank statement are consistent or compatible with the amounts in the companys cash account in its general ledger and vice versa. The bank statement lists the activity in the bank account during the recent month as well as the balance in the bank account. When you have this formula in balance your bank reconciliation is complete.

1 compare the both opening balances of cash book and bank statement these might be different because of un presented or un credited cheques from the previous period. The formula is cash account balance per your records plus or minus reconciling items bank statement balance. One statement being made before computing the total amount of cash both on hand in bank is the statement of bank reconciliation. Excel bank reconciliation formula here are a couple of excel formulas we can use to get our reconciliation done before lunch.