Bank Reconciliation Statement Format As Per Cash Book

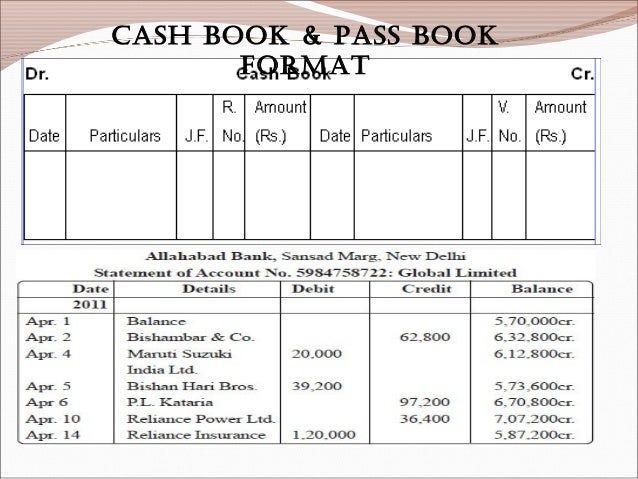

Are deposited in the bank the cash book bank column is debited ie.

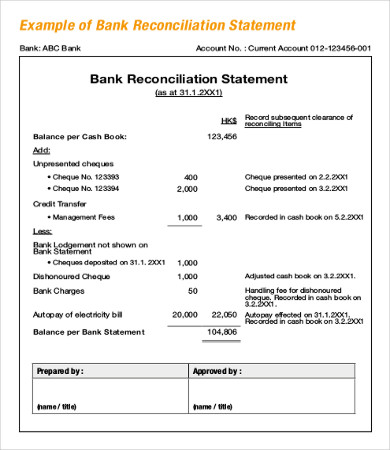

Bank reconciliation statement format as per cash book. Each time cash cheques money orders or postal orders etc. Explanation of cash book and bank statement most businessmen use a two or three column cash book with a bank column for recording transaction made through the bank account. Therefore the proper method of preparing a bank reconciliation statement is to first make the required entries in the cash book ascertain the correct balance and then proceed to the preparation of the statement. Has a difference in the balance as per cash book and bank statement as on 31 st march 2019.

An entry is made in the bank column on the debit side of the cash book. The bank statement a bank statement is a copy of a bank account as shown by the bank records. This must be a direct deposit received by the bank. This must be a direct deposit received by the bank.

The balance as per pass book should match to balance at bank as per cash book. Locate them on the bank statement and tick off these and opening balances as now agreeing. The balance at bank as per cash book will thus be rs 35430. Bank statements are sent out to customers on a regular basis for example.

Now we shall move to discuss some additional and specific steps. Unpresented cheques taverner trading company 60 puccini partnership 100 b britten ltd 80 240 765 less. Balance at bank as per cash book 525 add. 1 compare the both opening balances of cash book and bank statement these might be different because of un presented or un credited cheques from the previous period.

Outstanding lodgements 220 300 520 balance at bank as per bank statement 545. A deposit of 5000 received by the bank and entered in the bank statement on 28 may doesnt appear in the cash book. Bank reconciliation example 3. In the above paragraphs we have discussed the general points that have to be kept in view while preparing the bank reconciliation statement.

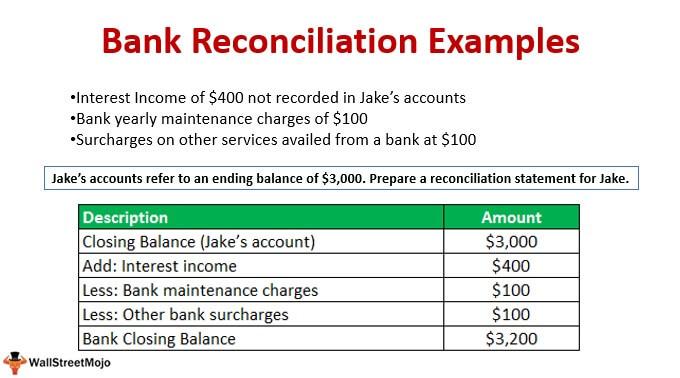

Balance as per cash book is 1400. Balance as per bank statement as on 31 st march 2019 is 4000. You are advised to prepare a bank reconciliation statement as on that date with the following information. Put the difference as balance as per cash bookpass book or overdraft balance as per cash bookpass book as the case may be.