Bank Reconciliation General Journal Entries

Riaan louw over 10 years ago.

Bank reconciliation general journal entries. Definition of journal entries in a bank reconciliation. The bank statement for august 2019 shows an ending balance of 3490. Journal entries hit the cash account on the ledger. This entry reduces cash in your account.

These entries serve to record the transactions and events which impact cash but have not been previously journalized eg nsf checks bank service charges interest income. The accounting concepts of. We will assume that a company has the following items. I have written a few general journals to correct entries on my bank account in my general ledger.

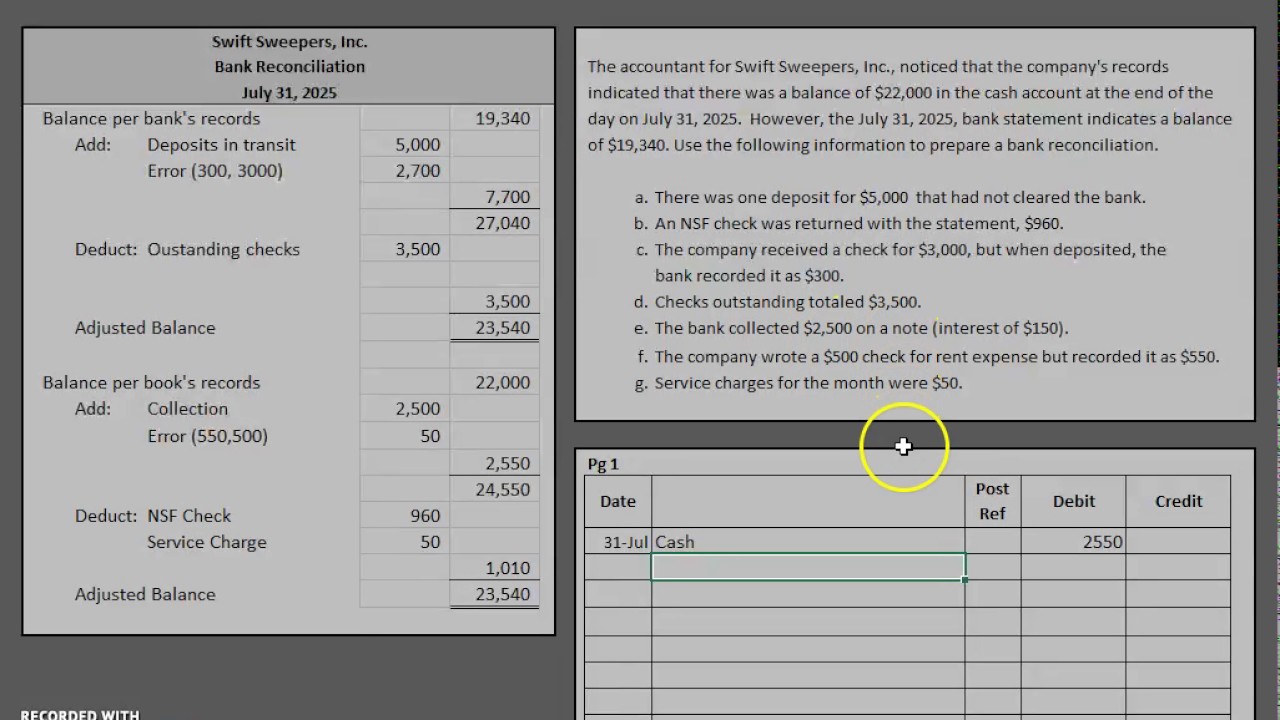

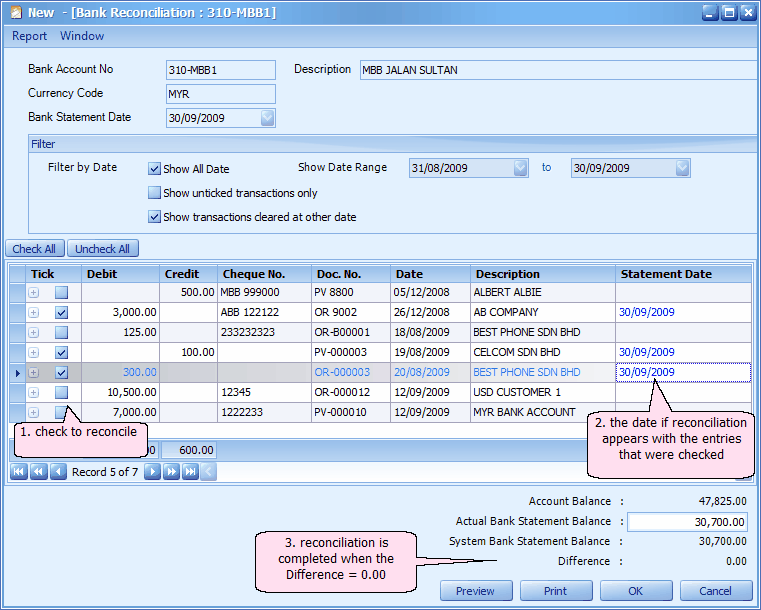

On august 31 the bank statement shows charges of 35 for the service charge for maintaining the checking. These are the items that appear on the bank statement but are not yet recorded in the companys general ledger accounts. They are reflected as cleared in the bank reconciliation even though it will not let me see those to check them or not. In this part we will provide you with a sample bank reconciliation including the required journal entries.

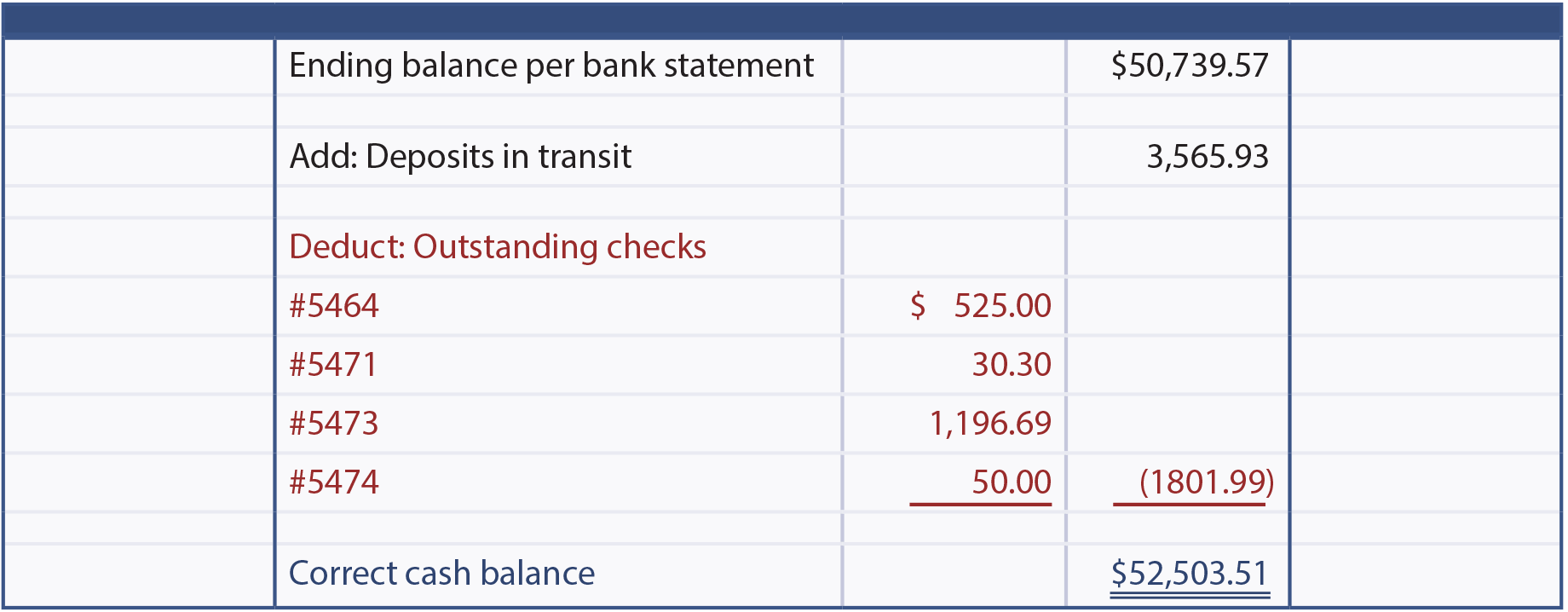

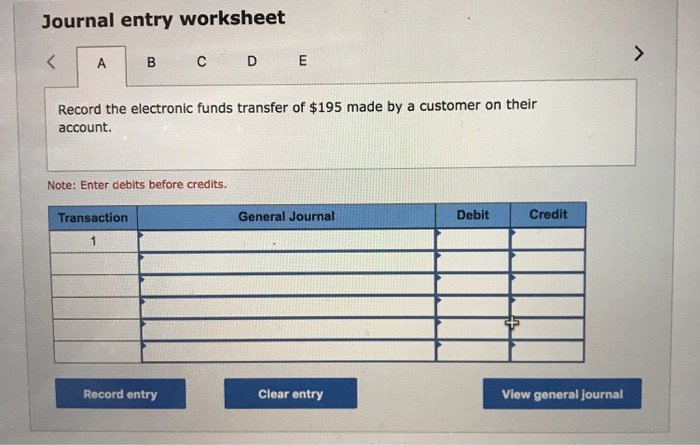

Sample bank reconciliation with amounts. I have way too many entries to go back and delete each one. These journals do not appear on my bank reconciliationand now my bank reconciliation keeps on differing from my general ledger account with these amountshow do i reconcile these general journal entries on. Journal entries for bank reconciliation the items on the bank reconciliation that require a journal entry are the items noted as adjustments to books.

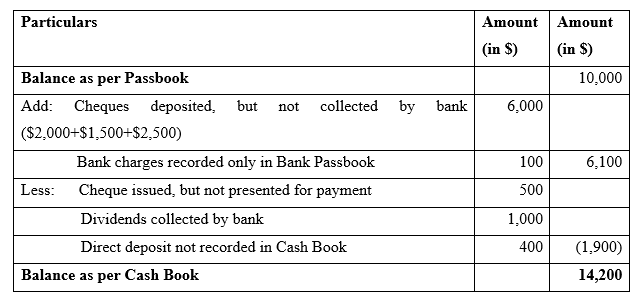

Journal entries are required in a bank reconciliation when there are adjustments to the balance per booksthese adjustments result from items appearing on the bank statement that have not been recorded in the companys general ledger accounts. Once the correct adjusted cash balance is satisfactorily calculated journal entries must be prepared for all items identified in the reconciliation of the ending balance per company records to the correct cash balance. This check box is available only if the bank reconciliation module is integrated with general ledger and deposit is selected at the transaction type field in the transaction journal format window. Accountants record adjusting entries to ensure the account holders records match the banks data.

The bank reconciliation journal entries below act as a quick reference and set out the most commonly encountered situations when dealing with the double entry posting relating to bank reconciliation adjustments. They do so by debiting and crediting financial accounts such as assets liabilities and expenses. The majority of transactions are jes and reconciling the bank. Learn how to journalize the entries required at the end of a bank reconciliation.

Examples of journal entr. In each case the bank reconciliation journal entries show the debit and credit account together with a brief narrative. For example to record a bank fee in an account holders books debit the bank fee account and credit the cash account. Im simply trying to get this client caught up but how can i do that when i cant reconcile the bank.

What journal entries are prepared in a bank reconciliation.