Analysis Of E Banking In India

Atms are at your doorstep.

Analysis of e banking in india. Indian banking industry today is observing an it. Analysis based on the impact of bancassurance product on banking business in india the performance of both banks and insurance companies inter depend on each other. Soldier co ed college jalandhar. Challenges and opportunities kumari nidhi assistant professor department of commerce ahir college rewari abstract financial sector plays an important role in the economic development of a country.

Current and future prospects 9 figure 3 s hows graph ical presentation o f rtgs volume with tren d line and with linear equation which e n ables to analyse t he future p. Growth and extent of electronic banking services in india 41 e banking services through websites of the banks 42 sample description 43 sample period 44 key electronic banking services 45 analysis of electronic banking services 46 conceptual framework of atms 47 kinds of atms 48 reasons for adoption of atms for the customers and the banks 49 growth of onsite and offsite atms in indian. It is the most crucial financial intermediary as it connects surplus and deficit economic agents. Assistant professor assistant professor in commerce st.

The following study shows the impact of bancassurance on the overall financial performance of banks in india. Moreover with the advent of. E banking in india and its present scenario and future prospects. Banking sector is the building block of an economy and plays a pivotal role in the financial structure of any nation.

The indian scenario dr. Banking is the lifeline of an economy. This report describes the current state of internet banking in malawi and analyses its implications for the malawian banking industry. Traditional banking structureon it adoptionthe indian banking sector woke up to the world of technology in early1990s.

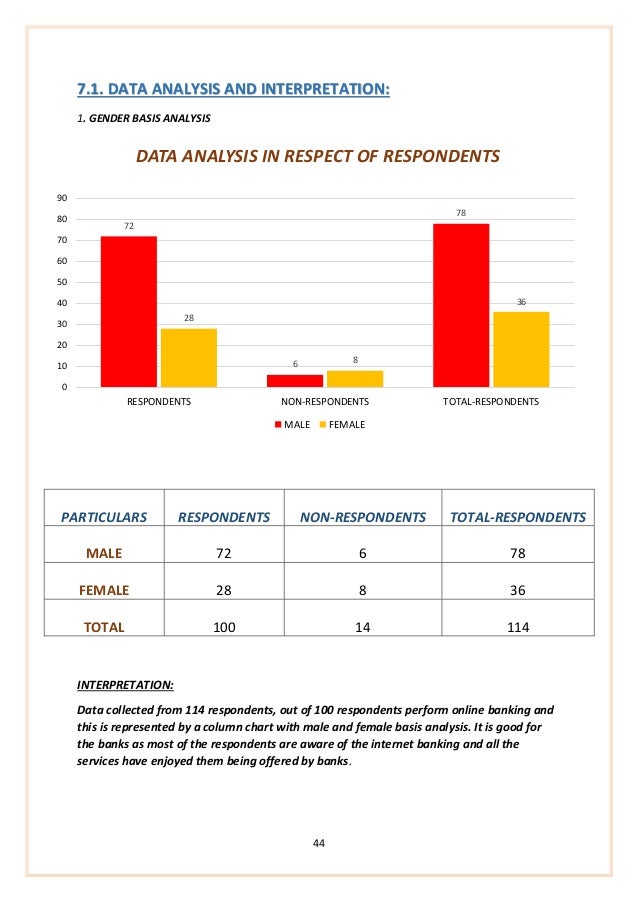

The banking sector in india has been dominated by public sectorbanks who hold between them more than 80 of total asset base. It particularly seeks to analyze internet banking and examining its impact on commercial banks performance. A strong and healthy banking system is important requirement for economic growth. Data analysis and interpretation 112 p a g e data analysis and interpretation the previous chapter reviewed the growth structure of retail banking in india and found that various products like home loans consumer loan educational loan retail deposits atms facilities etc.

Abstract today most of the banking happens while you are sipping coffee or taking an important call.