Bank Reconciliation Statement Example

Current account 012 123456 001.

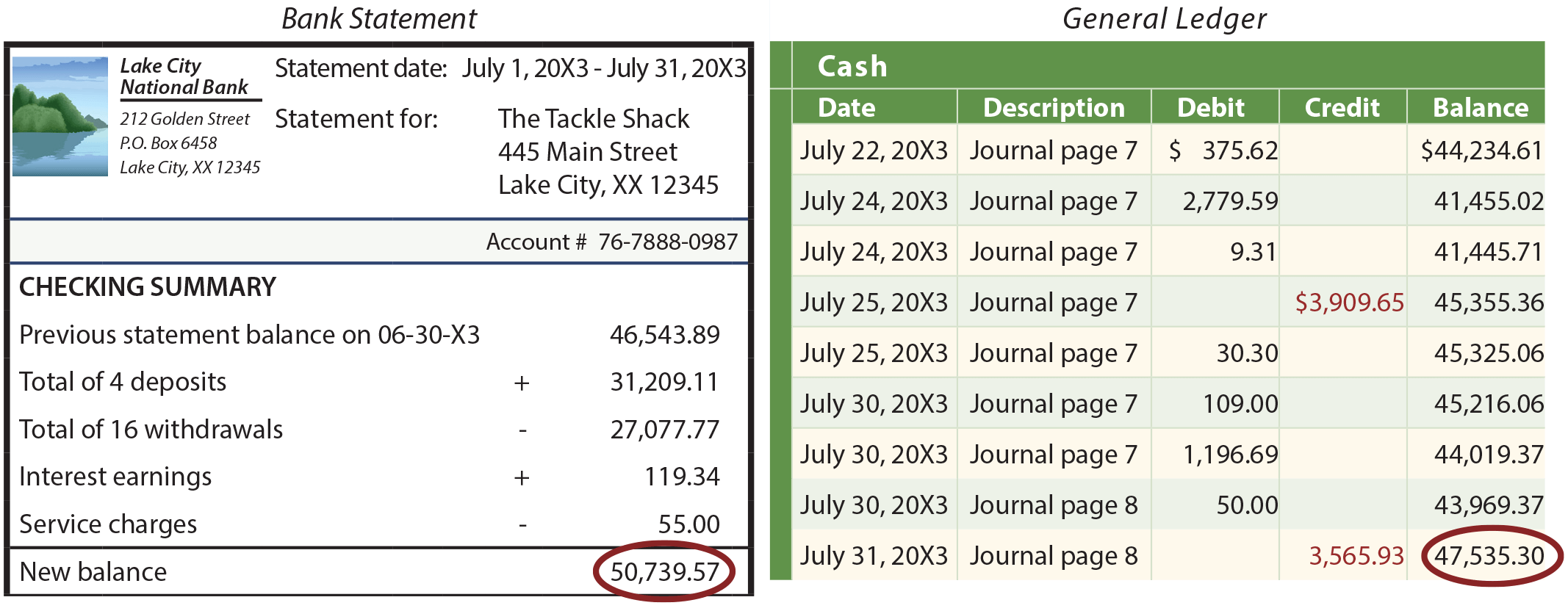

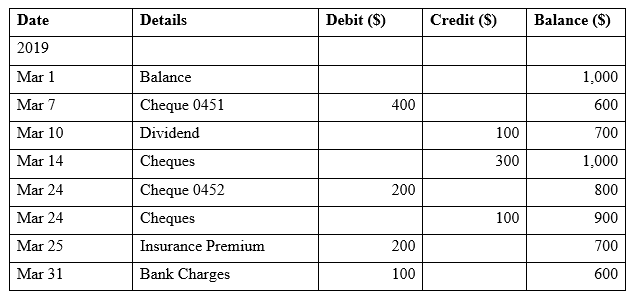

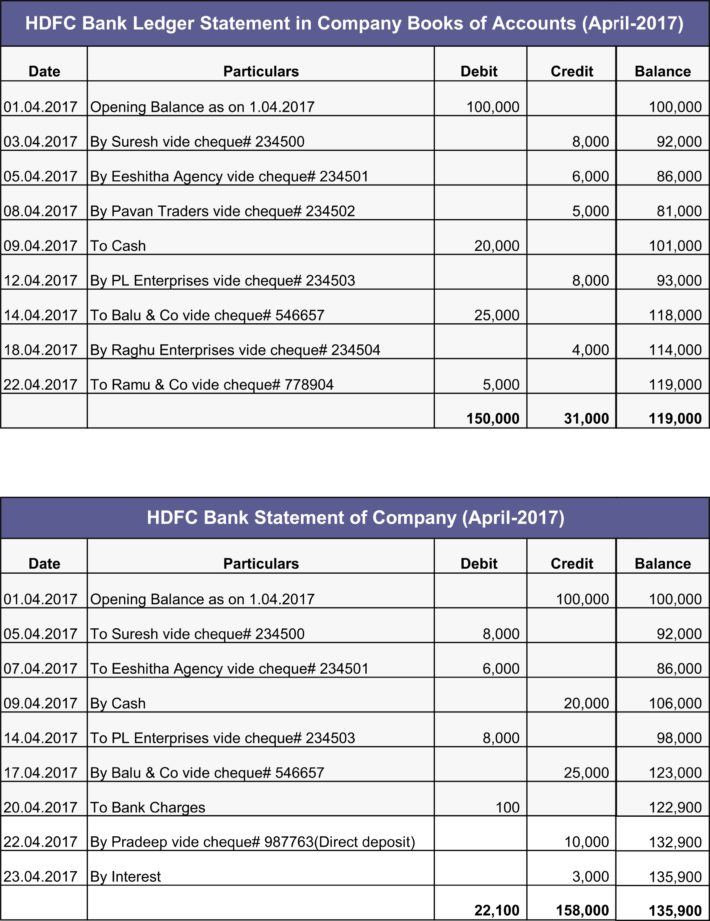

Bank reconciliation statement example. Bank reconciliation is done by customers of the bank in order to tally their records along with their respective banks statements. Deduct any outstanding checks. Has a difference in the balance as per cash book and bank statement as on 31 st march 2019. Bank reconciliation example 3.

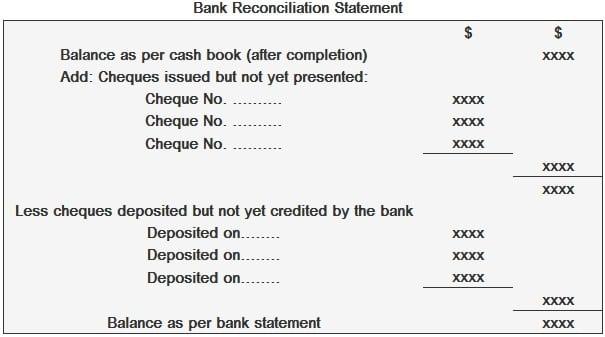

Balance as per bank book is 8000. A bank reconciliation statement may be defined as a statement showing the items of differences between the cash book balance and the pass book balance prepared on any day for reconciling the two balances. Feel free to click and download on a sample to access the file. Balance per bank statement 104806 bank reconciliation statement as at 3112xx1 prepared by.

Feel free to click and download on a sample to access the file. 9172009 33946 pm. On the bank statement compare the companys list of issued checks and deposits to the checks shown on the statement to identify uncleared checks and deposits in transit. As the bank provides their statement periodically generally monthly but sometimes more frequently if requested upon charge there may be some differences in customers books of accounts and those of the bank which generates the need of reconciliation.

Bank reconciliation formula example 1. Name title name title note. All transactions between depositor and the bank are entered separately by both the parties in their records. Using the cash balance shown on the bank statement add back any deposits in transit.

From the following particulars prepare bank reconciliation statement for ms xyz and company as at 31 st december 2018. Bank reconciliation statement is a statement that depositors prepare to find explain and understand any differences between the balance in bank statement and the balance in their accounting records. In order to agree both the balance we prepare bank reconciliation statement. Statement examples in excel shown in the page provide further information regarding the making of a reconciliation statement.

The figures used in the above bank reconciliation statement are for illustrative purpose only example of bank reconciliation statement bank. You are advised to prepare a bank reconciliation statement as on that date with the following information. The reconciliation statement helps identify differences between the bank. Balance as per cash book is 1400.

Balance as per bank statement as on 31 st march 2019 is 4000. The account balance of both the customer and bank should tallybut in most case it do not happen due to various reason.